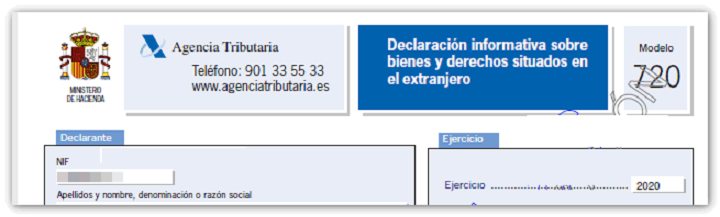

At Pérez Parras Economists & Lawyers we are specialists in tax Form 720 Spain, as well as in international taxation. We have extensive experience in double taxation models, as well as in the declaration of assets and rights abroad of tax residents in Spain.

It is the result of our accumulated experience that allows us to offer a high-quality service and, specifically, to prepare the submission of the Form 720 Spain to comply with the legislation in force, but, in turn, optimizing your taxes according to your particular case.

We submit the 720 Form Spain for both natural and legal persons with assets and rights abroad and, for that aim, we count on a multidisciplinary team of professionals who combine Tax Law and Economics, which allows us to address the taxation of Form 720 Spain of the highest complexity.

Thanks to our experience in the approach and preparation of Form 720 Spain, we know in depth the procedure to remedy the deficiencies, file the appeals before the Spanish Tax Office and deal with to penalties of the Form 720 Spain.

The information return on assets and rights abroad must be submitted from January 1 to March 31 of the year following the one that refers to the information to be supplied, for this tax that started in 2013.

Who is required to file Form 720 Spain?

Both natural and legal persons, who, having the obligation to present both personal income tax and corporate income tax, respectively, possess assets or rights abroad, must present Form 720, provided that the balance as of December 31 exceeds 50,000 euros, or in case of bank deposits when your average balance exceeds 50,000 euros. This is:

- Accounts deposited in financial entities abroad.

- Securities, rights, insurance and income deposited, managed or of which the beneficiary is abroad.

- Real estate and rights to real estate located abroad.

- Very shortly, obligation to also declare cryptocurrencies.

Conclusions to Form 720 Spain:

It should be borne in mind that the Spanish Tax Agency has increased the control of assets abroad due to the growing collection of international tax information, so it is of interest to make the information return of Form 720 Spain, even extemporaneously if applicable, to avoid derived penalties of failure to comply with the obligation, as well as its relationship with the Wealth Tax and personal Income Tax.

Therefore, if you are a natural or legal person residing in Spanish territory with assets and / or rights abroad, or if you have your habitual residence abroad as a member of Spanish diplomatic missions, Spanish consular offices, office holders or official employee of the Spanish State as member of delegations and permanent representations accredited to international organizations, etc., you must report by using said Form 720.

Do not hesitate to contact us to request our quote, or to appoint a face-to-face meeting at our offices in Malaga town centre or in Nerja. We can help you in the preparation of the Form 720 Spain with all the guarantees.

Related Projects

Form 720 Spain

-

Category

LEAVE A REPLY