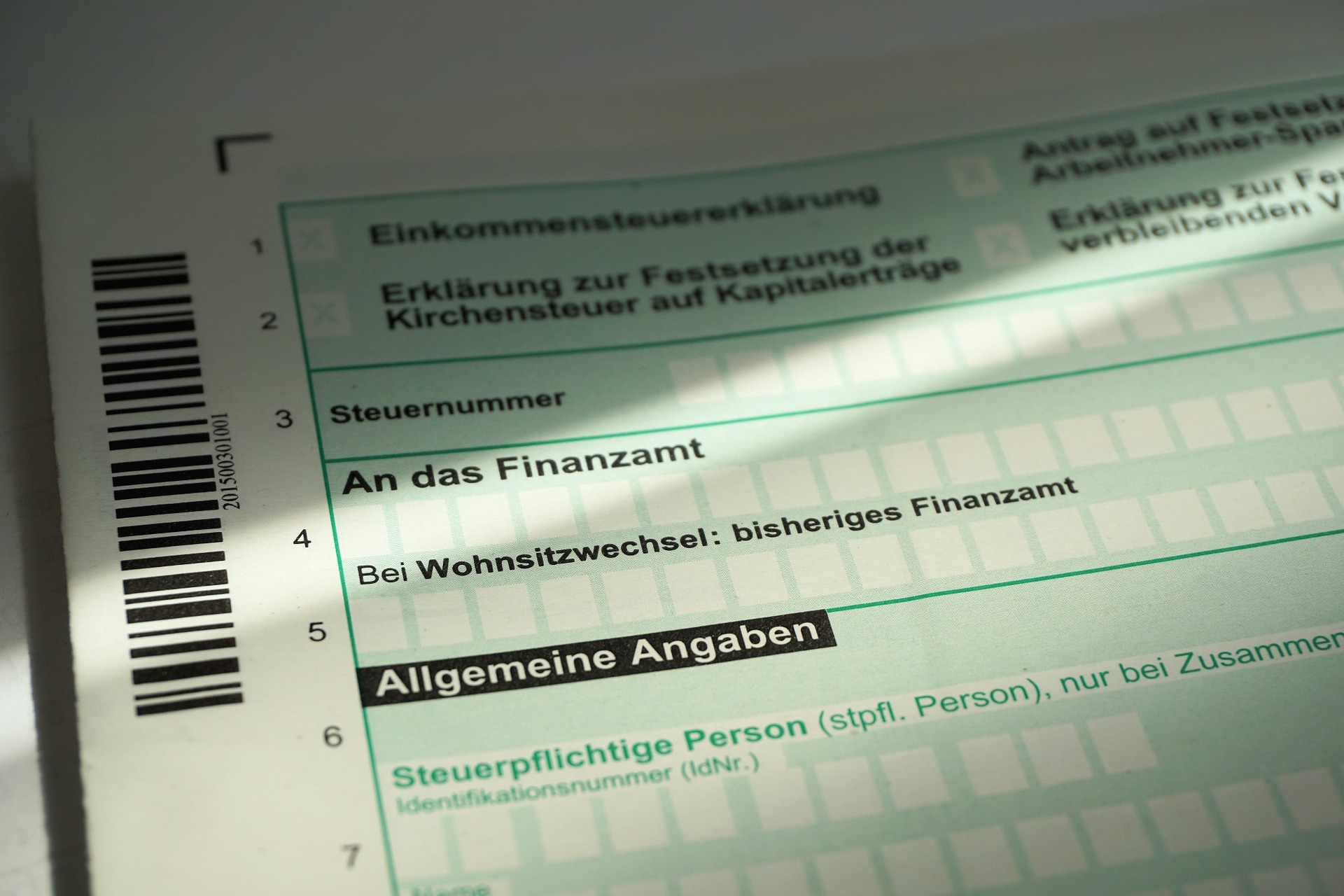

2016 tax season starts soon, so we recommend that you encourage you to begin to prepare all the necessary documentation to be able to elaborate it.

Key dates for submitting the tax return:

– From April 5 to June 30, the period to confirm the draft online begins.

– From May 11 to June 30, the deadline for submitting in person, at the offices of AEAT (Agencia Tributaria) and collaborating entities, begins.

– In any case, on June 26, the term for the income to be paid with direct debit ends.

It is remarkable that there are still people who do not know whether they are obligated to submit the annual income tax returns. The situation is further complicated when you are foreign national in Spain and you are completely unknowledgeable of the Spanish tax compliance.

Pérez Parras Economist & Lawyers

We have already come across this case in this office. Our client, an Englishman who has been living in Spain for 15 years, did not know that the unemployment benefit he received was considered to be an employment income, therefore it is considered to be a second payer that, together with the remuneration of his first payer, obliges him to submit his annual income tax return. A matter that the Spanish Administration has informed him via numerous requests in different years. The Tax Agency offers several options for submitting your income tax return, but not all of them are advisable from our point of view.

As a novelty in 2016 income tax return, they have definitively replaced the PADRE PROGRAMME software and allow since the last campaign, that you can submit the income tax return online by yourself, using your PC, smartphone or tablet, but the disadvantage is that not all the data corresponding to your tax situation will be reflected on the draft that you access, which may cause expenses to remain not deducted, such as expenses for the purchase of a habitual residence.

From May 4 to June 29, you may request an appointment for free preparation of your INCOME TAX RETURN in the appropriate tax office, but you can not imagine the number of people who come to our office with requests for not having submitted correctly -with wrong date- their income tax returns. That you prepare your income tax return with the help of the Administration but it is done wrong -with information that the Administration might ignore or misunderstand- statement in the Administration and it is wrong, does not discharge you guilt or the possible sanctions derived from it.

We recommend that you use the services of an independent consultant to prepare your INCOME TAX RETURN. From our office of Economists and Lawyers, we put at your disposal our expertise and knowledge in this matter and the latest fiscal novelties looking for any benefit that allows a saving in your tax declarations.

For a small fee you will gain peace of mind. Please feel free to contact us, surely it will pay off.

Pérez Parras – Economists & Lawyers

Phone: +34 680 34 87 68

Offices:

- Málaga town centre: Calle Cortina del Muelle, 21, 3ºC. CP:29015 – MALAGA.

- Nerja town centre: Avenida Pescia, 4, Bajo B.

Email: info@perezparras.com

LEAVE A REPLY