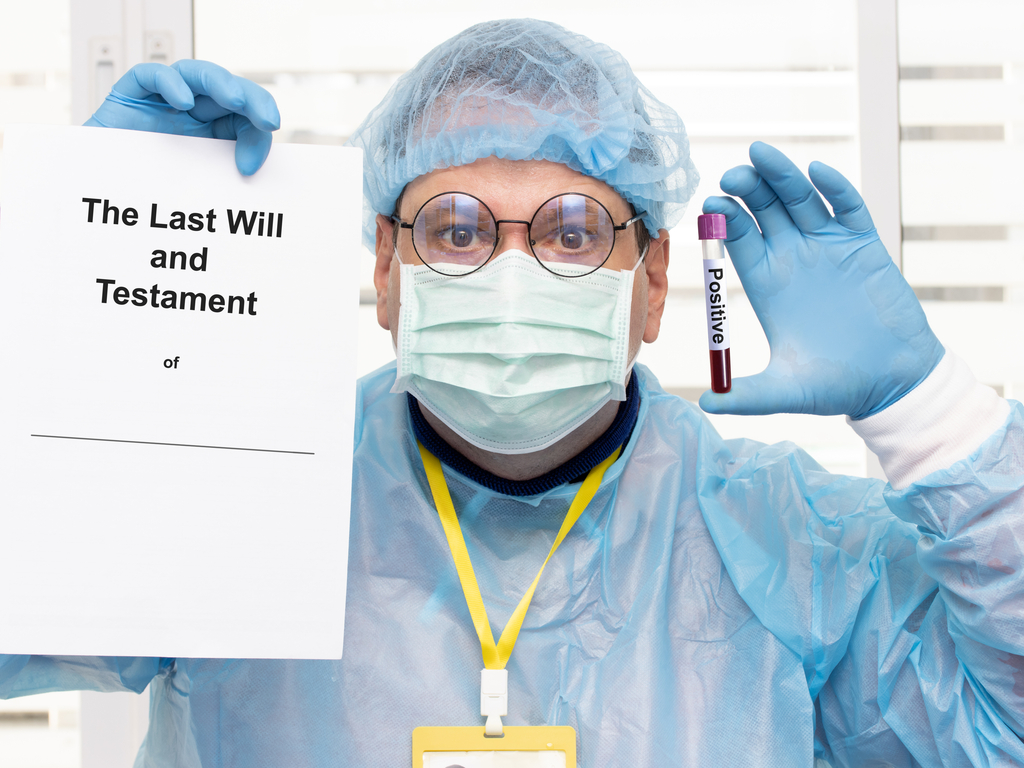

Wills in times of pandemic: It is important to prepare the succession (inheritance) in times of pandemic, due to COVID-19. For this, the legislation allows the granting of three types of Will in this period of health crisis, depending on the specific case:

o Will in case of epidemic

o Holographic will

o Will in danger of death.

Of these 3 types of Will, it is interesting to note that only the personal Will retains its validity if the testator survives the pandemic, since it does not require the existence of a pandemic or illness of the testator since, the Will that is drawn up in times of pandemic expires when the aforementioned pandemic ends.

The Will signed in time of a pandemic expires two months after the end of the epidemic state. The same period of two months being the one that operates in the case of the Will granted in danger of death.

And, is that, as established by our Civil Code, the Will signed in time of pandemic expires two months after the end of the epidemic state. The same period of two months being the one that operates in the case of the will granted in danger of death, said will losing its effectiveness if the testator leaves the danger of death within that period of two months.

Inheritance: What validity requirements does the holographic Will have and what effects does it have after the Covid-19 pandemic?

The requirements of the holographic Will in the inheritance are as follows:

- The person who makes a will must be of legal age and be able to read and write.

- You do not need a lawyer or notary to intervene, nor do you need witnesses. It is an intimate and personal testament, that will help your heirs.

- Inform a trusted person of the testator that he has drawn up a will (holograph), and where it will be kept.There is a danger of loss of the Will.

- It must be written entirely in the handwriting of the testator, in his usual handwriting, so that it cannot be concluded that he wrote it under the duress or interference of another person.

The holographic will can be executed in a foreign country, even when the laws of that country do not allow the form of the holographic will.

Regarding its validity, the holographic Will has the following qualities:

- It can be granted at any time, and does not require that a state of pandemic has been previously declared.

- It is difficult to prove one of the main requirements to ensure its validity: the testator’s (legal) capacity, and that he writes it under his free decision. There is, therefore, a danger of not capturing the necessary will of the testator, that would not help your heirs and their inheritance procedure.

- The Will must be written in its entirety, and not contain crossed out or corrected words, or between lines, which can only be saved with the signature of the testator.

- It can be granted in a foreign country, even when the laws of that country do not admit the form of the holographic will.

- The Will must contain, at the beginning or at the end, in letters or numbers, the full date (day, month and year), the place and the signature of the testator.

- If the testator dies, the person who has the holographic Will in his possession must present it to a Notary Public within 10 days of having knowledge of the death. Term, which is important to note that it has been suspended during the validity of the state of alarm.

- After being presented to the Notary, the latter will summon 3 witnesses to verify the authenticity of the letter and signature of the testator.

Therefore, the holographic Will collides head-on with the use of new technologies, since it cannot be drawn up by computer means, nor be digitally signed. Thus, the electronic testament that has no legal validity in any of its forms.

If you need to process your inheritance, or prepare your Will, do not hesitate to contact the Pérez Parras Economists & Lawyers Firm. We count on a professional team of lawyers who are experts in the preparation, management and resolution of your inheritance and associated taxes and all other aspects involved, as well as the preparation of your Will, for residents and non-residents, nationals and foreigners. We are located in Malaga capital and Nerja.

LEAVE A REPLY