You must submit your spanish Wealth Tax return if, after applying the corresponding deductions or allowances, the tax liability is payable to the spanish Tax Agency, or if the value […]

Read more ›

The well-known Beckham Law, named after the footballer for whom it is said to have been created, applies to you if you are a worker posted to Spanish territory so, […]

Read more ›

The Non-Resident Income Tax in Spain (IRNR) is a tax on income obtained in Spanish territory by individuals or legal entities that are not resident in Spain. When is a […]

Read more ›

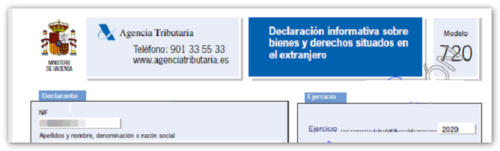

At Pérez Parras Economists & Lawyers we are specialists in tax Form 720 Spain, as well as in international taxation. We have extensive experience in double taxation models, as well […]

Read more ›

The Office Perez Parras Economists & Lawyers comprises an area of Fiscal and Tax Law counting on multidisciplinary experts in its staff, that allows us to offer integrated solutions and […]

Read more ›